Sign up for the Family Tree Newsletter! Plus, you’ll receive our 10 Essential Genealogy Research Forms PDF as a special thank you.

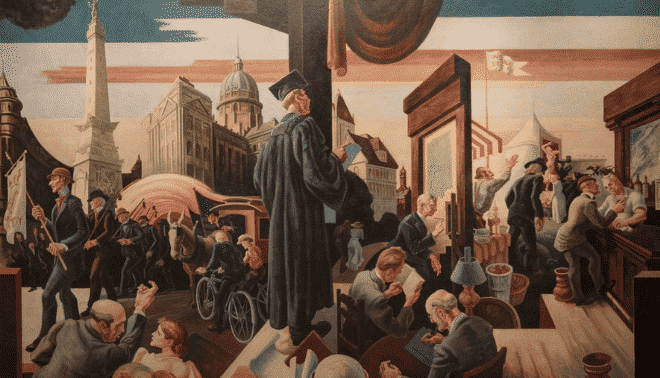

As you endure tough times today, it may be some comfort that your ancestors also weathered economic woes. Financial crises are nothing new—America has faced panics and depressions since before Congress chartered the First Bank of the United States in 1791.

For your ancestors, just as for you, an economic panic, recession or depression could lead to a job change, unemployment, migration, property loss, savings depletion and worse. Today, though, cushions such as unemployment insurance, Medicare and the Federal Reserve help lessen the impact.

“The same things happening today happened back then,” says Richard Sylla, an economic and financial historian at New York University’s Stern School of Business. “[Today,] we’re a much richer country and we have some safety nets.”

But knowing how a roller-coaster economy impacted your ancestors is more than an exercise in empathy—it can aid your family history knowledge. If you understand the historical background of the time, you could uncover some significant chunk of your ancestors’ lives, such as why they picked up and moved or how they eked out a living. Think of it as the genealogical version of “trickle-down economics”: Take stock of these seven major US financial meltdowns to learn how the fallout likely affected your family (and perhaps put your own tough times in perspective).

Panic of 1819

Following economic growth after the War of 1812, the new republic saw its first major financial crisis in the Panic of 1819. Economists differ on exactly what caused it—too much government-issued credit for buying land, reduced European purchases of American goods, or other factors. The Bank of the United States and state and private banks recalled loans, money became scarce and few could pay their bills. The results: widespread real estate foreclosures, bank failures and a slump in agriculture and manufacturing.

Hundreds of thousands lost their jobs, scores of businesses went bankrupt and land values plunged. Unemployment soared to 75 percent in Philadelphia, where nearly 2,000 workers were imprisoned for owing money. In Boston, 3,500 debtors went to jail. Unemployed masses set up tent cities on the outskirts of Baltimore. On the frontier, record numbers of farmers defaulted on debt and lenders foreclosed on their land and homes.

Recovery came in the mid-1820s, but not before the Supreme Court shot down several states’ efforts to levy taxes on the Bank of the United States. Lingering anti-bank sentiment contributed to the rise of Andrew Jackson, who figured into the next big panic.

Panic of 1837

Land speculation fever took hold of America in the 1830s, but the fever broke May 10, 1837, in New York City, the day banks stopped making payments in specie (gold and silver). The resulting panic began a depression marked by hundreds of bank failures and record-setting unemployment.

Some blamed President Andrew Jackson, who’d vetoed Congress’ bill to renew the charter for the Second Bank of the United States in 1833. He withdrew the government’s money and deposited it in state banks, which funded risky investments and printed too much paper money, leading to inflation. In 1836, Jackson issued the Specie Circular (or Coinage Act) requiring payment for government land to be in gold and silver. Panic ensued when Americans tried to exchange their bank notes for specie, only to find many banks lacked the reserves to pay them. Martin Van Buren, Jackson’s successor, stands accused of refusing to regulate banks and letting a depression drag on until 1843.

Not only did prices rise, but wages and property values sank. Workers took a 50 percent pay cut on average. Americans had less to spend, so many businesses closed up shop. Individuals defaulted on loans and states couldn’t pay their debts to the federal government. Public projects, such as canals and roads, came to a halt. The slowdown in cities was more severe than in rural areas, where farmers, though hurting from falling crop prices, could at least grow food for their families. Some reverse migration occurred as well—people who’d moved years earlier to cities for jobs returned to live with rural relatives.

Panic of 1857

The Mexican-American War was over and gold was discovered in California—the early 1850s were boom times. But the prosperity came to a halt when a recession emerged in 1856, primarily due to Europe’s post-Crimean War decline in US crop purchases. The influx of gold aggravated the situation by inflating US currency.

Then the Ohio Life Insurance and Trust Co. collapsed after an embezzlement scandal at its New York City branch. The fall of this major financial force triggered the Panic of 1857, as investors in other companies withdrew their money.

Bank closures and business failures spread across the nation and then to Europe, South America and the Far East. Ensuing events further shook public confidence: British investors pulled funds from American banks; grain prices fell, spreading the economic heartache to rural areas; new rail routes came to a stop, shutting down land speculation programs and ruining countless investors; and a hurricane sank a shipment of 30,000 pounds of gold from the San Francisco Mint. Fortunately, the panic lasted just 18 months, with the economy recovering around the start of the Civil War.

Panic of 1873

A second transcontinental railway called the Northern Pacific Railroad collapsed in 1873. Soon after, Sept. 18, the Philadelphia banking firm of Jay Cooke and Co., which had invested heavily in the Northern Pacific, announced it would suspend payment on notes. That set off a chain of events culminating in the Long Depression, which lasted until 1879.

The railroad industry, the nation’s largest employer outside of agriculture, had become oversized after years of

government-promoted speculative lending. Real-estate speculation was similarly rampant. Within a day of Jay Cooke’s shocking announcement, more banks began to fail. The New York Stock Exchange closed for 10 days.When the panic had run its course 40 days later, 73 members of the stock exchange and 5,000 mercantile companies had gone under.

But the depression continued. Factories laid off workers; unemployment had reached 14 percent by 1876. Farm prices dropped and railroad construction dramatically slowed. Wage cuts and poor working conditions plagued railroad workers, who voiced their unrest through the Great Railroad Strike of 1877. President Rutherford B. Hayes sent federal troops to end the strike; fights killed more than 100. The depression finally lifted in the spring of 1879, just as the great wave of US immigration was beginning.

Panic of 1893

But it seemed the country hadn’t learned its lesson when another “railroad bubble” popped in 1893 and touched off a panic—considered the worst economic crisis in America to that point. Businesses were stretched thin to get in on the railroad boom. The Philadelphia and Reading Railroad failed Feb. 23, 1893, followed by banks invested in it. The National Cordage Co., the country’s most actively traded stock, went bankrupt as its creditors began calling in their loans.

The Northern Pacific; Union Pacific; Atchison, Topeka and Santa Fe; and other railways collapsed. At the same time, new mine products—especially silver from the West—had flooded the market. The price of silver plummeted.

Americans rushed to banks; as they tried to redeem silver notes for gold, federal gold reserves diminished to their legal minimums. Many silver mines closed, as did the railways built to serve them. More than 15,000 companies and 500 banks failed, 115 of them in the West, where many were indebted to Eastern banks.

City and rural folk alike suffered. Unemployment, particularly in Northeastern industrial cities, soared to 20 to 25 percent. Farmers faced falling crop prices. Many members of the middle class, having lost their life savings to bank failures, had to abandon recently built homes.

It wasn’t until 1896, after the election of President McKinley, that the economy finally began to recover. The Klondike Gold Rush helped restore confidence, and the country embarked on a decade of rapid growth.

Panic of 1907

A recession was in progress: The stock market had fallen 50 percent from its peak in 1906 and money was, to say the least, tight. Across the nation, banks and businesses were closing due to their lenders’ retraction of loans. Americans had lost trust in financial institutions.

This perfect storm of events led to the Panic of 1907, also known as the Banker’s Panic, the country’s fourth panic in just 34 years. An attempt to corner the market on United Copper Co. stock was unsuccessful; banks that had lent money to the scheme suffered runs that spread to other banks. Treasury Secretary George B. Cortelyou deposited $35 million of federal money in New York banks as financier J.P. Morgan organized a team of financial executives to guarantee investments.

The panic ended a few weeks later. Though short, it inspired a growing consensus that the country needed a central bank to regulate currency and mitigate financial crises. In 1913, Congress passed the Federal Reserve Act.

The Great Depression

The Roaring ’20s brought rollicking prosperity for many Americans, who enjoyed smoking, drinking, dancing to jazz, buying new appliances and other luxuries on credit, and investing freely in a largely unregulated stock market.

But the end of the decade would prove disastrous. Oct. 29, 1929, known as Black Tuesday, share prices on the stock market crashed following several days of wild swings. The Great Depression spread around the world and lasted until the onset of World War II.

During the devastating Depression, nearly half the country’s 25,000 banks failed and Americans’ economic confidence sank. The combo created a downward spiral of reduced spending and lower production. Manufacturing and international trade declined, as did personal incomes, business profits and prices. Nearly a quarter of the workforce was unemployed, though the numbers varied for different groups—in 1930, half of African-Americans were out of work. Farming communities were hit particularly hard as crop prices fell up to 60 percent, and severe drought ravaged the Upper Midwest and West.

President Herbert Hoover, who initially dismissed the crisis as “a passing incident in our national lives,” eschewed legislative relief measures in favor of voluntary efforts that had minimal effect. Shantytowns that sprung up around the country were called “Hoovervilles” after him. The Federal Reserve, having reached the limit of credit it could issue, did little to stop bank failures. The nation began to climb out of the depths after Franklin Delano Roosevelt won a landslide presidential victory in 1932 and initiated New Deal programs.

Take a break from today’s bad economic news and get to know your ancestors’ world.

Don’t Panic Do the labels “panic” and “depression” make you think of psychology instead of the economy? Grasping these key economic classifications will not only make you feel smarter, but it’ll give you a better perspective on the times your ancestors lived through.

Click here for even more economic definitions.

- depression: a cyclical period of serious decline in a national economy, with decreased business activity across most sectors, a decline in gross domestic product (GDP), higher levels of unemployment, rising business bankruptcies, and in the most severe instances, falling prices (deflation)

- economic downturn: negative change in the economy, such as a move from growth to recession

- panic: sudden, widespread fear of economic collapse, leading to massive bank withdrawals and/or falling stock prices

- recession: a period of general economic decline lasting longer than a few months, measured by indicators such as GDP, employment, real income and sales

From the March 2009 Family Tree Magazine